Banking system in India. Why banks in India are facing difficulty in getting deposits?

Do you agree that banks in India are facing difficulty in getting deposits?

Further insight into banking systems around the world

Current Indian Banking System Scenario

Two points for what was happening in banking and investment sector in the last 5 years:

- Increased consumerism: If we look at the consumption pattern in last 5 years, people were moving from being savers to consumers, i.e., more emphasis on benefits gained today rather than gains received through savings in future, this changing attitude is one of the reasons for higher growth in lending compared to deposits.

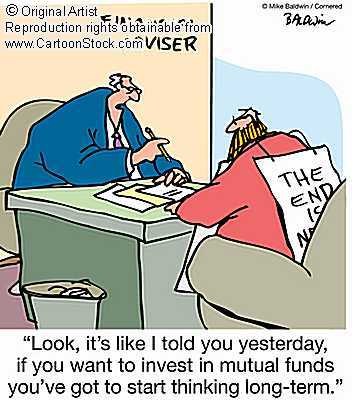

- Alternatives and risks: People were looking for more alternatives like mutual funds, different insurance schemes, stock market, etc. People were moving to these products with higher return expectations. These instruments also have higher risk and increased income level people who deposit high amounts of money into banks were ready to take these high-risk alternatives.

But now the situation will be slightly better for banking system in India because investors are losing a lot of wealth in stock markets and mutual funds. People will realize the importance of safer investment vehicle and will start diversifying their portfolio with increased exposure to safer instruments like bank deposits.

The banks in India generate their funds from two types of sources:

Long-Term Sources:

- Tier one and Tier two Capital in the form of equity/subordinate debts/debentures/preference shares.

- Internal accrual generated out of profits.

- Long-term fixed deposits generated from public and corporate clients, financial institutions, and mutual funds, etc.

- Long-term borrowings from financial institutions like NABARD/SIDBI.

Short-Term Sources:

- Call money market, i.e., funds generated among interbanking transactions where there is online trading of money between bankers.

- Fixed deposits generated from public and corporate clients, FIs, and MFs, etc.

- Market-linked borrowings from RBI.

- Sale of liquid certificate deposits in the open market.

- Borrowing from RBI under Repo (Repurchase option).

- Short and medium-term fixed deposits generated from public and corporate clients, mutual funds, and financial institutions, etc.

- Floating in current and saving accounts.

- Short-term borrowings from FIs by way of rated papers placed, etc.

RBI plays a role of regulator apart from money provider in specific cases.

Right now this seems to be a short-term crisis unless the production figures of the next month also shows negative trend like it has shown in the month of August @ 1.30% (very low compared to the previous figures of between a band of 5 to 9%).

If IIP figure goes down continuously for the next 2 to 3 months, we have to assume, there is a recession in the country. As the service industry may not grow at the volumes shown previously. The industrial growth is a big hope for the future sustenance of the growth in India.

Now let us analyze the situation of all these sources in the present scenario for the banks:

A) This is not the right time to generate the funds from long-term sources due to the bad market scenario, so let us focus on the short-term sources.

B) Call money market is very tight. RBI borrowings and placing short term papers is not the best way to generate funds as the mutual funds and FIs are facing acute pressure due to withdrawals from the foreign investors including NRIs.

Hence pressure is on retail deposits and now every bank wants to concentrate on these as a source. The rates are increasing. This is a very good time to keep money in a 2- to 3‑year lock deposit with nationalized banks. You may be offered 10.50 to 10.75%. It would be 0.25-0.50% higher in case of the private/foreign and co-operative banks.

I would like to give all credit to the regulatory system in India, which has withstood to the acute pressure on banking sector. You would remember the co-operative bank fiasco 3 years back and now foreign and private banks are under scanner. Thanks to the mature regulatory system, we are relatively safe as far as banking in India is concerned.

All about Indian banking system on the net

- Indian Banking System: All Geared Up!

Banking services in India is on an all-time high these days. The banking system has been resurrected and has gone through a positive facelift with the advancement in the financial and economic trends of the country. No doubt, the people of India are - Business Portal of India : Growing a Business : Financial Support : Public deposits

- http://www.google.co.in/url?q=http://economictimes.indiatimes.com/Interview/VA_Joseph_Chairman__CEO_

- http://www.livemint.com/2008/12/21214546/An-American-perspective-on-how.html

- Banking in India: Banking on Retail

Article examines the Indian banking system and where the Indian banking sector is headed in the future.